OUR MAJOR SECTORS

Major Sectors

Our expertise spans across diverse industries, enabling us to provide tailored taxation and financial solutions.

From individuals and small businesses to large corporations, APC Corporate Consultancy LLP is equipped to meet the unique needs of every sector we serve.

-

Our taxation experts understand the unique challenges faced by food processing and trading businesses. We provide specialized services covering: Inventory valuation and accounting for perishable goods, Compliance with food safety regulations and associated tax implications, Input tax credit optimization for raw materials and processing equipment, Export/import taxation guidance for international food trade, Tax planning for seasonal business fluctuations, GST compliance and filing for food products across different tax slabs.

-

We offer comprehensive taxation solutions for the steel industry, addressing the complex supply chain and manufacturing processes: Tax optimization for raw material procurement and processing, Asset depreciation strategies for heavy machinery and equipment, Input tax credit management for power consumption and fuel, Compliance with environmental regulations and related tax implications, Transfer pricing for international steel trading, Tax planning for long-term contracts and project-based operations.

-

Our expertise helps exporters navigate both domestic and international tax frameworks: Export documentation and tax compliance, Duty drawback claims and refunds, Zero-rated supply management under GST, Foreign exchange transaction tax implications, Tax benefits under various export promotion schemes, Cold storage and logistics-related tax planning.

-

We provide specialized taxation services for the unique requirements of the Ayurvedic medicine sector: Compliance with pharmaceutical taxation regulations, R&D tax incentives and deductions, Patent-related tax benefits, Tax planning for clinical trials and research, GST compliance for different categories of medicines, Manufacturing license-related tax implications.

-

Our taxation services for petroleum retailers focus on the specific challenges of the sector: Fuel pricing and tax component calculations, Daily price revision impact on taxation, State-specific petroleum tax compliance, Inventory valuation methods for tax purposes, Environmental compliance tax implications, Working capital optimization through tax planning.

-

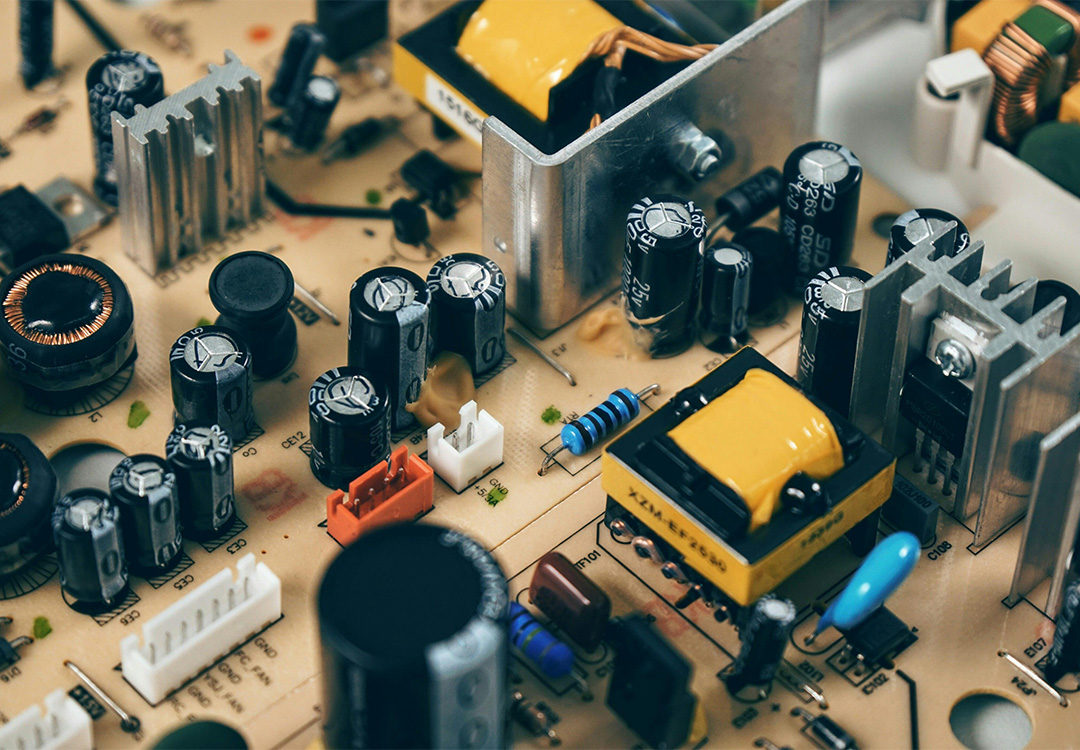

We assist electrical product manufacturers with comprehensive tax solutions: Manufacturing process tax optimization, Input tax credit management for components and raw materials, R&D tax incentives for product development, Export incentives and tax benefits, Compliance with safety standards and related tax implications, Tax planning for warranty and after-sales service.

-

Our taxation services cater to the diverse needs of wholesale and retail businesses: Inventory management and tax implications, Supply chain tax optimization, Multi-location tax compliance, E-commerce taxation solutions, Credit sales tax management, Season-specific tax planning.